*UPDATE*: As of 1.13.23, the California Franchise Tax Board HAS NOW conformed to the extension.

US updated Information: CLICK HERE

CA updated Information: CLICK HERE

(below information current as of 1/13/23)

Dear Clients and Friends,

Good news! The Governor’s office has announced that California will conform to the filing extensions granted by the IRS for California storm victims. This means the FTB has extended filing and payment deadlines for many individuals and businesses in California until May 15, 2023.

This relief applies to the following deadlines falling on or after January 8, 2023, and before May 15, 2023:

· Individual income tax returns;

· Business return filings normally due between March 15 and April 18, 2023;

· Third and fourth quarter estimated tax payments due on January 17, 2023, and April 18, 2023. Individual taxpayers can skip making the fourth quarter estimated tax payment and instead include it with the 2022 return as long as the return is filed on or before May 15, 2023;

· IRA and health savings account (HSA) contributions; and

· Quarterly payroll and excise tax returns, normally due on January 31, 2023, and April 30, 2023.

In addition, the FTB will suspend the mailing of collection notices to affected taxpayers for the next 30 days, beginning January 13, 2023.

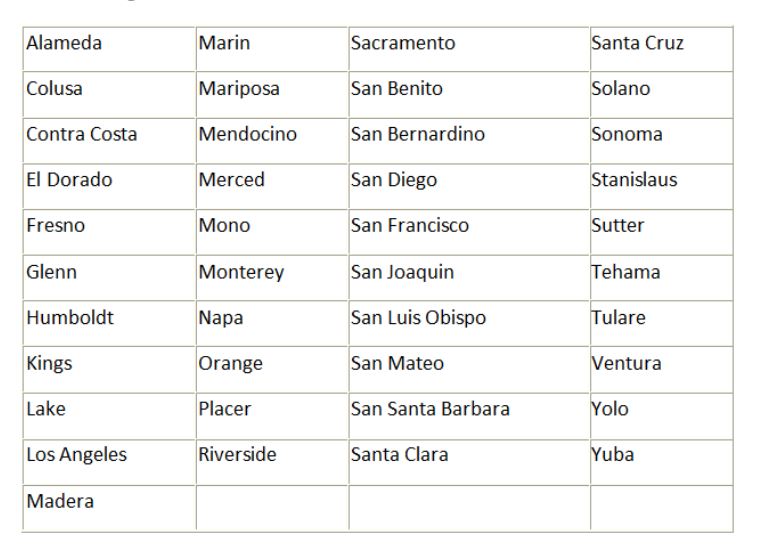

The relief is automatically available to taxpayers who reside or have a business in the following counties:

The Governor’s news release is available at: www.gov.ca.gov/2023/01/13/tax-relief-for-californians-impacted-by-storms/

The Vanderbilt Team

—below information from 1/11/23—

Dear Clients and Friends,

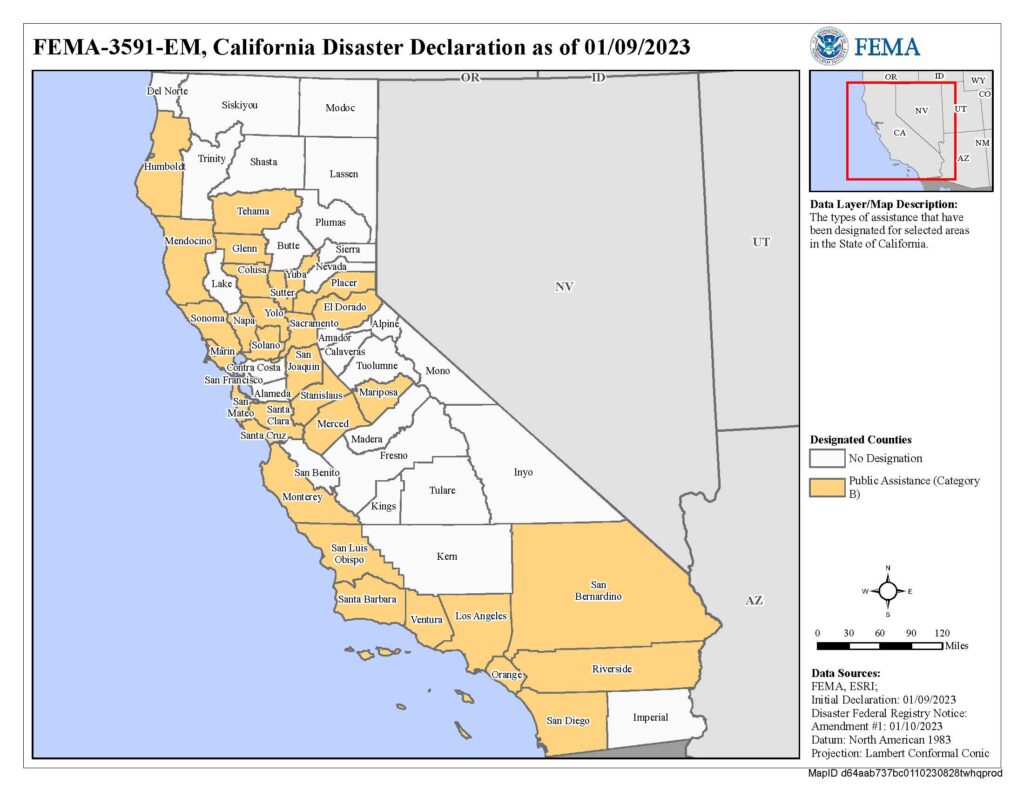

Whew, what a week, and it’s only Wednesday. We will keep you apprised as updates occur, but as of this morning the Internal Revenue Service has offered a lifeboat of sorts to California residents and businesses floundering in the atmospheric river: More time to pay federal income taxes. The agency announced that taxpayers in any county covered by a federal emergency declaration (see map below) will have until May 15 to file their income tax returns for 2022. If the declaration is extended to more counties, the IRS will grant them the extra time as well.

*UPDATE* NOTE: the California Franchise Tax Board HAS (as of 1.13.23) conformed to the extension.

The relief will be offered automatically to anyone whose address on file at the IRS is in a disaster area — no need to ask for help or alert the agency that you’ll be filing late. If the IRS sends you a penalty notice anyway because you missed a deadline that should have been waived, the agency advises you to call the number on the notice to have the penalty erased.

The delay to mid-May applies to everything that ordinarily would face deadlines of April 15 or earlier in 2023, including making tax-favored contributions to an IRA or a health savings account.

For businesses and other filers who pay estimated or interim taxes, the payments due in January, March and April have been postponed as well. You can make them when you file your annual return on or before May 15.

The same is true for quarterly payroll and excise tax returns, which ordinarily would be due Jan. 31 and April 30. But payroll and excise tax deposits due Jan. 8 will still have to be made by Jan. 23 to avoid penalties.

If you live outside the designated disaster area, you can still qualify for the delayed deadlines if you meet any of three conditions:

· Records you need to complete your return are inside the area (for example, if you’re a shareholder in an S Corporation inside the affected area),

· your tax preparer is inside the disaster area and unable to complete the work on time,

· or you are helping the government or a recognized charity with relief efforts in the area. But you’ll need to let the IRS know by calling (866) 562-5227. One other point: If you suffer disaster-related losses that aren’t reimbursed or insured, you can write them off on your tax return for either 2022 or 2023.

Stay tuned for further updates and stay dry!

The Vanderbilt Team